How Much Are Travellers Paying for Airport Passenger Tax in Africa?

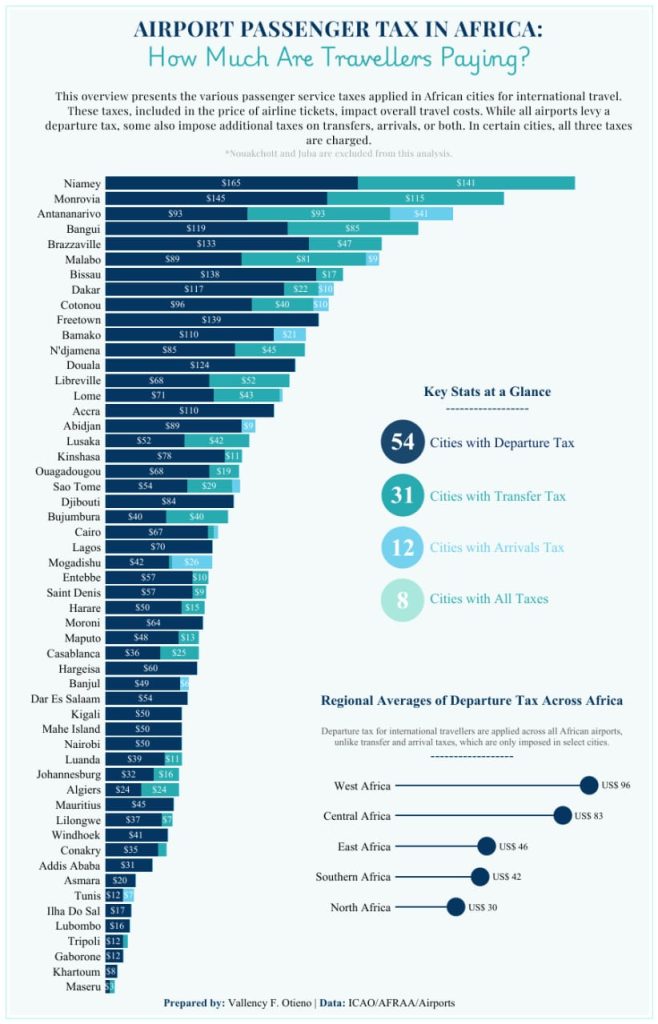

The analysis investigates passenger service taxes for international travel in African cities. These taxes are included in the ticket prices and significantly affect the total cost of air travel. While all airports in Africa implement a departure tax, some also impose additional taxes for transfers or arrivals. In some cities, passengers may encounter all three types of taxes.

As we explore these insights, here is a visual analysis of Airport Passenger Service Taxes across Africa.

Key Highlights

The average departure tax across the African cities is US$64, with a transfer tax averaging $34 and an arrival tax of US$12. Notably, while all 54 cities in the study impose a departure tax, only 31 cities levy a transfer tax, and a US$12 apply tax on arrival. Additionally, 8 cities across the continent levy all three taxes on travellers.

Niamey stands out for its exceptionally high airport taxes. Travellers departing from Niamey pay a departure tax of US$165—2.5 times the continental average—and a transfer tax of US$141, which is four times the average levied in other cities with similar fees. Monrovia follows, with a departure tax of US$145 and a transfer tax of US$114.

In the Southern Africa region, Antananarivo is the only city charging a departure tax above the continental average, at US$93, and it also imposes two additional taxes on travellers. Djibouti leads East Africa with the highest departure tax in the region at US$84. Meanwhile, North Africa has the lowest average airport taxes across the continent.

Among the top 20 cities with the highest airport taxes, 18 are in West and Central Africa, where ticket prices tend to be higher compared to East Africa. As of 2024, the average one-way ticket in Central Africa is US$333, followed by US$289 in West Africa and, US$234 in East Africa as of 2023.

Also read: Central Africa Air Connectivity 2024 Analysis

There is a modest correlation between airport taxes and passenger traffic. Africa’s busiest airports—including those in Cairo, Casablanca, Johannesburg, Tunis, Nairobi, Lagos, Algiers, and Addis Ababa—generally impose below-average passenger taxes. However, some cities with low taxes still report low passenger volumes. For example, Maseru charges just US$3 for both departure and arrival taxes, while Khartoum, Asmara, and Gaborone also levy minimal taxes yet do not attract high traffic. This suggests that other factors—such as policies, infrastructure, and a city’s attractiveness—play a crucial role in shaping air connectivity and airport traffic.

Tax Burden and Policy Reform

Examining airport taxes in Africa is crucial, particularly in the context of the Single African Air Transport Market (SAATM) initiative, which aims to establish a unified air transport market across Africa through industry liberalization. High and inconsistent airport taxes present a major obstacle to this goal, potentially discouraging airlines from serving certain regions, limiting connectivity, and reducing the overall competitiveness of the African air transport sector.

These high taxes can significantly increase ticket prices, often making air travel unaffordable for many. For example, a one-way ticket from Brazzaville to Douala—only a two-hour flight—can cost nearly US$400, largely due to these elevated taxes. In fact, taxes and other airport charges can account for up to 50% of an airline ticket price, ultimately burdening travellers with higher costs.

There is a clear need for policymakers and governments to understand the impacts of these taxes on the air transport sector and to pursue reforms that will foster a more integrated and efficient market across Africa. As Nowel Ngala, Executive Board Member and Chief Commercial Officer of TAAG – Linhas Aéreas de Angola, points out, imposing such taxes without reinvesting in the air transport sector discourages passenger traffic and limits the sector’s potential to support economic growth fully.

Ngala further argues that ICAO and IATA should go beyond policy development, advocacy, and lobbying by considering a revision of the Chicago Convention of 1944. This treaty did not prohibit aviation taxes and user fees, and Ngala suggests amending it to include provisions for sanctioning discriminatory or non-transparent charges. “We will strongly advocate for such amendments,” he states, highlighting that the aviation sector has evolved significantly since 1944, requiring updates in legislation to address the modern landscape.

Reducing taxes and charges could have a powerful effect on stimulating air travel demand across the continent. According to a 2020 report by AFRAA, the price elasticity of demand for air transport within Africa ranges from -2.34% to -3.15%. This implies that a 10% reduction in ticket prices could increase demand at the continental level by 22.3 to 30.1 million passengers annually, highlighting the potential economic and social benefits of addressing these tax-related barriers.

About Vallency Otieno

With 8+ years of experience in aviation, Vallency excels at driving results and improving performance by implementing data-driven strategies. His passion lies in using analytical insights to impact commercial development and policy formation within the aviation industry. Find more of his work HERE