Central Africa Air Connectivity 2024 Analysis

Central Africa’s Air Transport corridor has gained growing attention in recent years due to its critical role in the region’s economic development. The Corridor encompasses 11 airports in 10 countries, including Angola, DR Congo, the Republic of Congo, the Central African Republic, Cameroon, Gabon, Chad, Sao Tome and Principe, and Equatorial Guinea.

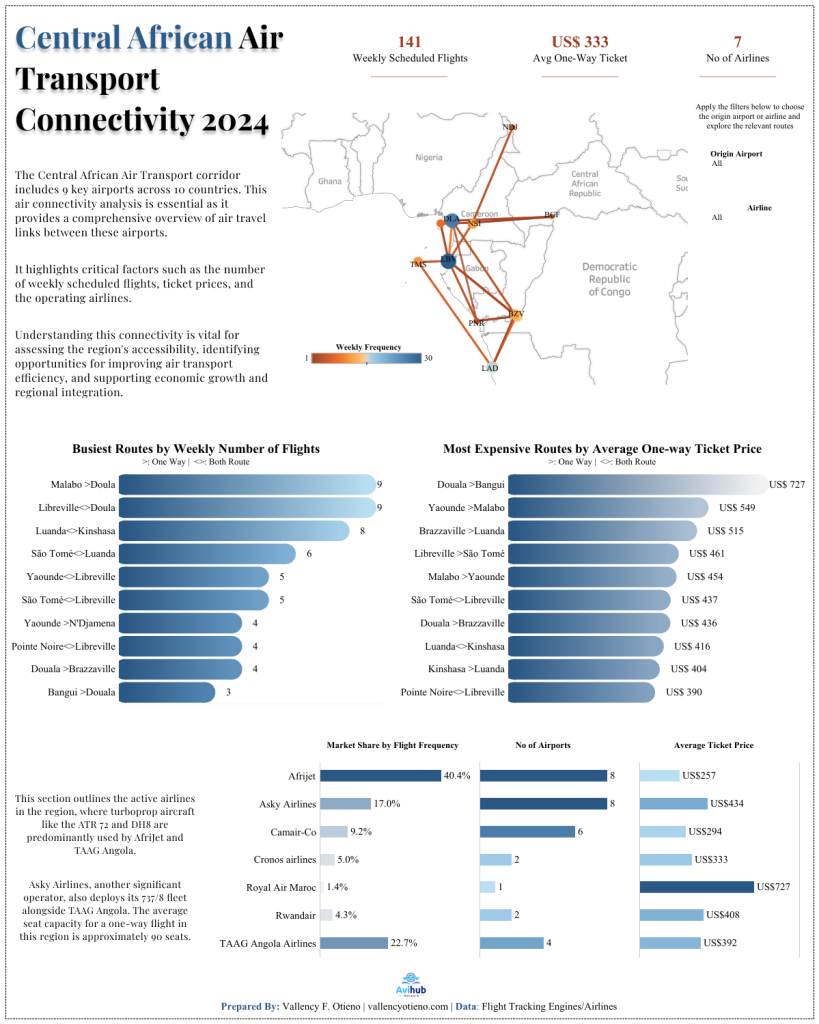

Key factors such as the number of weekly scheduled flights, operating airlines, and missing essential links are crucial to understanding the region’s air transport landscape. Analyzing this connectivity is essential for assessing regional accessibility, identifying opportunities to enhance air transport efficiency, and fostering economic growth and regional integration.

As we delve into the insights, here is the interactive link to the analysis of air connectivity in Central Africa:

Key Highlights

The busiest route in the Central African region is Douala (DLA) to Malabo (SSG), with only 9 scheduled weekly flights operated by two airlines, Afrijet and Cronos. This is considerably lower compared to the busiest routes in other regions, such as Nairobi (NBO) to Entebbe, which has 44 weekly flights, and Lagos (LOS) to Accra (ACC), with 48 weekly flights.

In terms of city connectivity, Libreville (LBV), Gabon, is the most connected city in the region, with scheduled flights to 7 destinations. This is largely due to Libreville being the hub for Afrijet, which holds a 40.4% market share in terms of flight frequency—the highest in the region. Afrijet also offers the lowest average ticket price at $257, for one-way flights compared to other airlines in the region.

On Route Connectivity

This region remains one of the least connected in Africa for intra-regional flights, especially when compared to Eastern and Western Africa. There are only about 141 scheduled flights within Central Africa, significantly fewer than the 994 in Eastern Africa and 735 in West Africa. This low number of flights correlates with the number of active airlines in the region— only 7.

Also read: How African Airports Can Embrace Data-driven Approaches to Enhance Operations and Retail Management

In contrast, Eastern and Western Africa each have over 15 active airlines with scheduled flights. This is a critical factor, as it directly impacts ticket prices. More airlines operating on a given route tend to increase competition, leading to lower ticket prices. The average cost for a one-way flight between two airports in Central Africa is $333, which is notably higher than in the other regions.

On the Cost of Travel

One factor that directly influences ticket prices is the Airport Passenger Service Charges (APSC), a tax applied to passengers departing, arriving, or in transit. This charge is included in the overall ticket price. Some cities impose the tax on all passenger movements, while others may apply it only to one, such as departures. The amount of the APSC varies by country, and higher taxes generally lead to higher ticket prices.

In the Central African Air Transport Corridor, 10 out of the 11 cities impose Airport Passenger Service Charges that exceed the continental average of $48. For example, Brazzaville, Congo charges $133 for departures and $47 for transfers, while Malabo, Equatorial Guinea applies charges to all three passenger movements: $89 for departures, $81 for transfers, and $9 for arrivals. Similarly, N’djamena, Chad charges $85 for departures and $45 for transfers.

A review of landing charges in this region reveals a similar trend—significantly higher landing and parking fees for aircraft compared to other regions. For example, daytime landing charges for a Boeing 737-7/8 are $1,117 in Bangui, Central African Republic, and $1,439 in N’djamena, Chad. In contrast, the same aircraft would be charged $223 in Nairobi and $470 in Johannesburg.

These elevated fees directly impact airline operations in these cities, driving up ticket prices and reducing the accessibility of air travel. As a result, the potential for air travel to foster socio-economic growth between key cities in the region is limited.

Opportunities for Improving Air Connectivity

Despite the challenges Central Africa faces, the region holds vast growth potential. With an area of approximately 6.67 million km² and an estimated population of 200 million as of 2020, increased investment, regional cooperation, and effective policy implementation could unlock significant opportunities for improving air connectivity.

Collaborative initiatives, such as the Economic Community of Central African States (ECCAS) and its implementation of the Central African Consensual Transport Master Plan (PDCT-AC), alongside the adoption of the Single African Air Transport Market (SAATM)—to which all countries in the region are signatories—could facilitate the development of unified strategies.

These efforts would help lower entry barriers for airlines, reduce operational costs, and increase competition. As a result, air travel could become more affordable and accessible, driving greater connectivity and fostering economic growth throughout the region.

About Vallency Otieno

With 8+ years of experience in aviation, Vallency excels at driving results and improving performance by implementing data-driven strategies. His passion lies in using analytical insights to impact commercial development and policy formation within the aviation industry. Find more of his work HERE